Trump is making bold promises to capture the digital asset industry's and investors' attention. Former president and 2024 Republican presidential candidate Donald Trump has delivered many broken promises in his political career.

This year, Trump has taken up crypto in an attempt to lure in crypto voters. On July 7, the Republican Party unveiled a draft of its political program, and crypto was specifically mentioned under its innovation program, next to the development programs for artificial intelligence and space expansion. The document summarized the main crypto objective of a Trump administration:

“Republicans will end

Democrats’ unlawful and unAmerican Crypto crackdown and oppose the creation of

a Central Bank Digital Currency. We will defend the right to mine Bitcoin, and

ensure every American has the right to self-custody of their Digital Assets,

and transact free from Government Surveillance and Control.”

The

political program was codified following Trump’s comments at the 2024

Bitcoin Conference in Nashville, where he said, “I pledge to the Bitcoin

community that the day I take the oath of office, Joe Biden and Kamala Harris’

anti-crypto crusade will be over,” stating firmly that “it will end. It will be

done.”

But will Trump really follow

through on these bold promises?

Bitcoin “made in the USA”

On

June 12, Trump posted

on Truth Social that he wanted “all the remaining Bitcoin to be made

in the USA,” claiming it would help the US become “energy

dominant.” Currently, 90% of the 21-million-capped Bitcoin supply has been

mined.

Ben

Gagnon, CEO of crypto mining firm Bitfarms, told Cointelegraph it’s “absolutely

possible and desirable to make America the number one country for Bitcoin

mining.”

Gagnon

said, “America will solidify its position as the most competitive place to mine

Bitcoin in the world if Trump reduces the red tape and increases support and

investment for energy and electricity infrastructure.”

Notably, Gagnon admitted

that one country can’t mine all the Bitcoin due to its decentralized

infrastructure:

“It’s not possible, nor

desirable, that 100% of Bitcoin are mined in the US or in any other country.”

Trump’s promise to mine the

remaining Bitcoin is not possible and is fundamentally contrary to the core

principles of its creator, Satoshi Nakamoto. Centralizing mining

operations within a single jurisdiction would dismantle Bitcoin’s foundational

value: decentralization.

Crypto can solve the US’ $35

trillion national debt

The

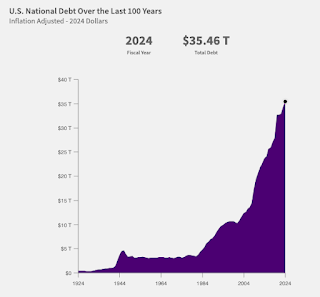

national debt is the total amount of outstanding borrowing by the US federal

government accumulated throughout the nation’s history.

According

to Fiscal Data, over the past 100 years, the US federal debt has increased from

$394 billion in 1924 to over $35 trillion in 2024.

During

an event related to his non-fungible token collection, Trump claimed that

“crypto has got a great future. I think it really does. Maybe we will pay off

the $35 trillion in crypto.”

Ric Edelman, founder of the

designation program for advisers platform Digital Assets Council of Financial

Professionals, told Cointelegraph he believes crypto could aid the chronic US

national debt issue:

“I have no doubt that a

Bitcoin reserve could sharply reduce and even perhaps eliminate our national

debt.”

However, he said he feels

equally confident that “Trump would not succeed in his efforts to create such a

reserve fund, or if he did, his successor would eliminate it.” Edelman admitted

Trump’s claim is a “fun sound bite on the campaign trail, but that’s all it

is.”

The US will create a

strategic Bitcoin reserve

In

addition to making the United States a world leader in Bitcoin mining, Trump

plans to create a strategic Bitcoin stockpile.

Trump’s

plan is for the US to hold 100% of the Bitcoin currently in its possession.

Many of those assets stem from seizures by law enforcement in criminal cases, which

could challenge his plan.

Almost half of the

government’s Bitcoin stockpile originates from a significant seizure following the Bitfinex hack. Since these assets

belong to affected victims, there’s legal pressure to return the funds to

Bitfinex or the impacted parties.

Recent: Harris

win unlikely to rock Bitcoin price, but crypto fears persist, say observers

Fortunately

for Trump’s plan, Senator Cynthia Lummis introduced a

bill to establish a Bitcoin strategic reserve, which, if approved, would create

a Bitcoin fund to hedge against the national debt. The goal is

to acquire 1 million BTC over five years to hold

for at least 20 years.

With backing in Congress,

Trump’s plan to create a Bitcoin reserve may actually have a chance of seeing

the light of day. Still, it will require a number of fellow lawmakers to

realize Bitcoin’s potential.

Fire Gary Gensler “on day

one”

Many

in the cryptocurrency industry have criticized the US Securities and Exchange

Commission for “regulating by enforcement.”

Under

Chair Gary Gensler, the commission has opened multiple cases against major

crypto firms for allegedly selling unregistered securities.

The

US crypto industry has been pushing hard for regulatory clarity, claiming that

current SEC guidance remains ambiguous. According to industry observers, this

lack of clear rules creates uncertainty, hindering market engagement and growth

within the US crypto sector.

One

of Trump’s most crystal clear promises is that he will fire Gensler “on

day one.”

Trump

argues that new leadership will bring a more crypto-friendly regulatory

environment and help the US crypto industry grow. However, can he actually fire

Gensler?

Firing

the SEC chair may not be as easy as Trump thinks. While he would not require

Senate approval to fire Gensler, throwing out an influential regulator so

unceremoniously could set a dangerous precedent and face political backlash.

The

president must dismiss the SEC chair “for cause,” meaning that Trump must

justify the dismissal on the grounds of neglect, inefficiency or some other

form of malfeasance. Furthermore, the entire process of establishing cause,

legal reviews and administrative transitions could take over a year.

So,

Trump will likely have to live with Gensler for a while before someone new

steps in.

Stop the development of a US

CBDC

Trump

has pledged to stop any development of a central bank digital currency (CBDC)

by the US Treasury, signaling his opposition to increased governmental control

over digital assets.

During

the Bitcoin Conference in Nashville, Trump claimed, “There will never be a CBDC

while I’m president of the United States,” describing the technology as an

imminent threat to financial privacy.

Trump

is not alone: Many Republican politicians have made public statements against

CBDCs, with the governor of Florida, Ron DeSantis, signing a bill to restrict their use in the state.

Congressman

Tom Emmer introduced the CBDC Anti-Surveillance State Act, prohibiting the

Federal Reserve from issuing a CBDC without congressional approval. The bill is

still in committee.

Set Silk Road operator Ross

Ulbricht free

During

the Libertarian National Convention, Trump said that — again on “day one” — he

would commute the sentence of Ross Ulbricht, who founded the darknet market

Silk Road, which permitted the illegal trading of drugs, weapons and other

unlawful goods.

Ulbricht’s sentence is highly controversial due to

its severity — a double life sentence plus 40 years without parole — for

nonviolent crimes.

Critics

argue that his punishment is excessive compared to sentences for similar

offenses, pointing to issues of judicial overreach, precedent for digital-age

crimes, and concerns about the criminal justice system’s handling of

first-time, nonviolent offenders.

“We’re

going to get him home,” Trump assured, claiming he’s already had enough jail

time, as “he’s already served 11 years.”

Trump

could quickly enact his promise, as a US president has the power to reduce the

length of a sentence or grant relief from a conviction for federal offenses.

A

commute wouldn’t absolve Ulbricht from his conviction but would allow his early

release.

Create a crypto advisory

council for precise crypto policies

Crypto

is a broad and complex topic, especially for regulators. Trump said in

Nashville that if reelected, he would create a presidential advisory committee

to ensure a solid regulatory framework for crypto becomes law.

“We

will have regulations, but from now on, the rules will be written by people who

love your industry, not hate your industry,” said Trump.

Trump

said that the task of the crypto council would be to “design transparent

regulatory guidance for the benefit of the entire industry, and they will get

it done in 100 days.”

Pseudonymous

crypto market analyst and trader Crypto Rand previously told Cointelegraph

that this promise may be one of the most significant, as

he believes Congress and the SEC have repeatedly demonstrated their lack of

understanding of the crypto industry and its dynamics.

Crypto self-custody as a right

Trump

has further promised to enshrine a right to self-custody for crypto users,

effectively codifying “not your keys, not your coins” into US federal law.

Trump’s

commitment to crypto self-custody is bolstered by legislation proposed by

Republican Senator Ted Budd. He introduced the

Keep Your Coins Act in the Senate on Nov. 7, 2023, which aims to prohibit

restrictions on Americans’ ability to transact through self-hosted crypto

wallets.

The

Republican lawmaker’s legislation stands at odds with a measure proposed by

Democratic Senator Elizabeth Warren in 2022. Dubbed the Digital Asset

Anti-Money Laundering Act, the bill would require crypto-market

participants to identify and track users with self-custodial wallets, including

crypto wallet service providers, miners and validators, among others.